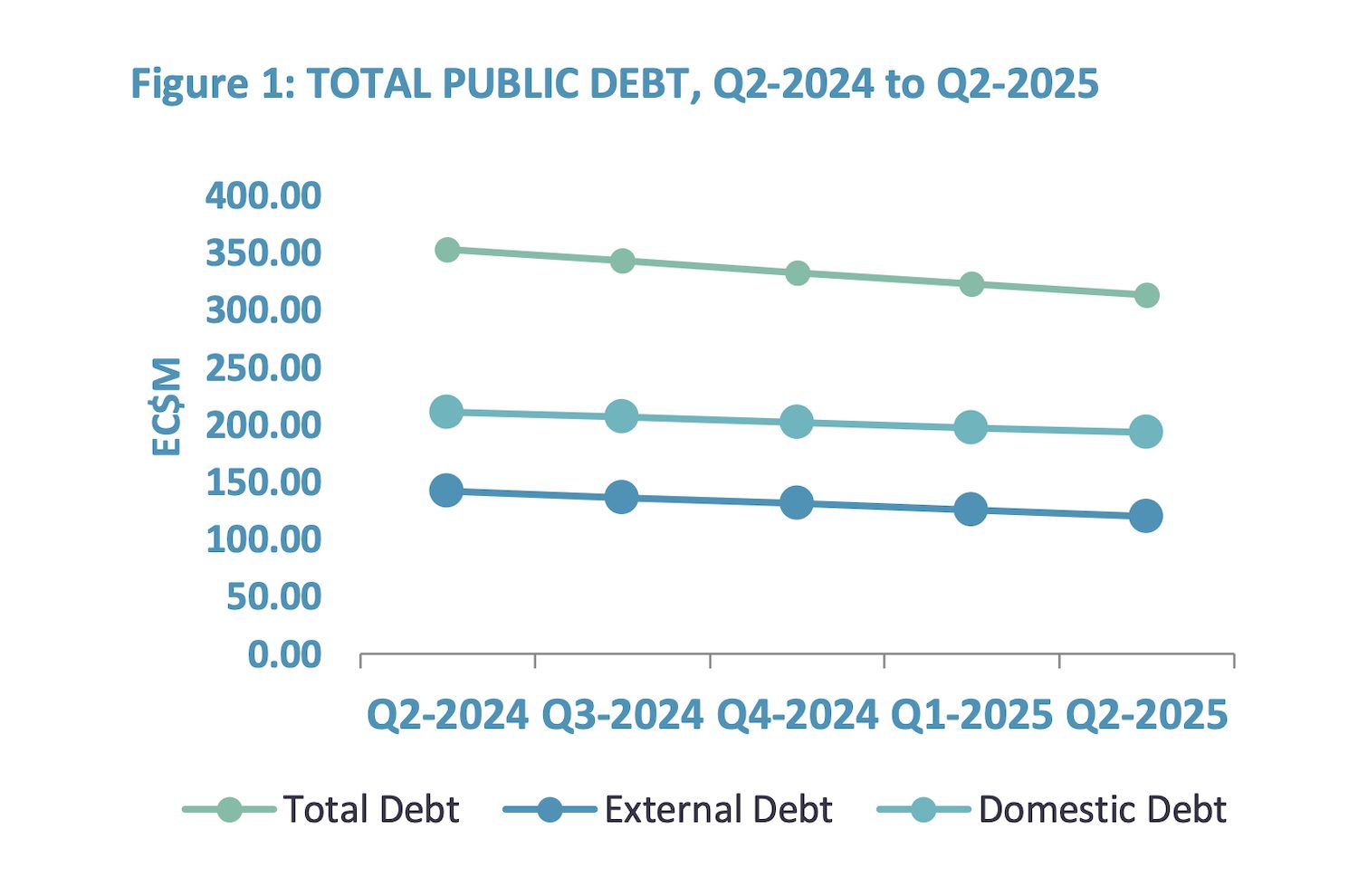

At the end of the first half of 2025, Anguilla’s total public debt stood at EC$312.99 million, continuing its steady decline from previous years.

The Public Debt Quarterly Bulletin for April to June from the Ministry of Finance, which was shared on 29 July, showed a $12.7 million decrease since the end of the first quarter.

The debt paid includes $9.6 million in principal repayment and $3.1 million in interest.

Speaking on the figures, Premier Cora Richardson Hodge said: “Managing debt is not just a fiscal obligation, its a reflection of the values we hold as a people.

“The government is staying the course: delivering relief responsibly, planning with discipline, and investing with purpose. We are not burdening future generations, we are building for them.

“Every dollar saved, every debt ratio met, is a step toward a stronger, more resilient Anguilla where our children inherit stability and opportunity.”

External vs domestic

The half year total includes 38.29% or $119.84 million in external debt – representing a decrease of 4.36% or $5.47 million since the first quarter.

This is down by 15.52% or $22.02 million compared to the same period last year. The main external creditor was the Caribbean Development Bank.

Domestic debt – what the government owes to local lenders – makes up the larger portion at $193.15 million or 61.71% of the total debt.

This figure has fallen by $4.10 million, or 2.08%, since the first quarter of 2025, and has decreased by $17.73 million, or 8.41%, from the same time last year.

The main creditor category was government related institutions, specifically the Anguilla Social Security Board (ASSB), which held 87.25% ($168.53m) of debt.

Another 6.63% ($12.8m) is associated with a private arrangement, the Depositors’ Protection Trust, and the other 6.12% ($11.83m) is related to the public-private partnership arrangement with Seven Seas Water.

Debt paid

The territory’s debt is governed by the Fiscal Responsibility Act and Framework for Fiscal Sustainability and Development (FFSD).

At the end of the first half of 2025, preliminary estimates indicated that the government is compliant with all three FFSD targets as agreed with the UK government.

The debt service to recurrent revenue ratio is compliant to its benchmark of 10% by 0.67 percentage points, according to the report from the Ministry of Finance.

The other two metrics – the ratio of liquid assets to recurrent expenditure and the net debt to recurrent revenue ratios – were also within the agreed benchmarks.

They surpassed them by 57.25 and 76.35 percentage points relative to their respective benchmarks of 25% and 80%

A full breakdown of Anguilla’s public debt figures, can be accessed in the Public Debt Quarterly Bulletin for April to June here.